Redspher

Artemid managed to bring in new investors in order to continue providing the group with support by offering it a perfectly tailored solution.

Senior Debt

2015, 2019

France

In portfolio

Redspher is Europe’s no.1 provider of tailor-made and on-demand logistical transport solutions catering for emergency or critical needs (“premium freight”). It boasts a strong technological culture and makes access to haulage companies easier and simpler thanks to digital platforms based on innovative models that automate and disintermediate the placement of orders.

Context

The group and its shareholder at the time (LBO France) decided in 2015 to launch a sale process. The aim was to bring in a new shareholder that would be able to support it through a phase of organic growth (by digitizing the model and incubating innovative models) and external growth in Europe, in order to expand the group’s geographic coverage in Germany and Spain in particular.

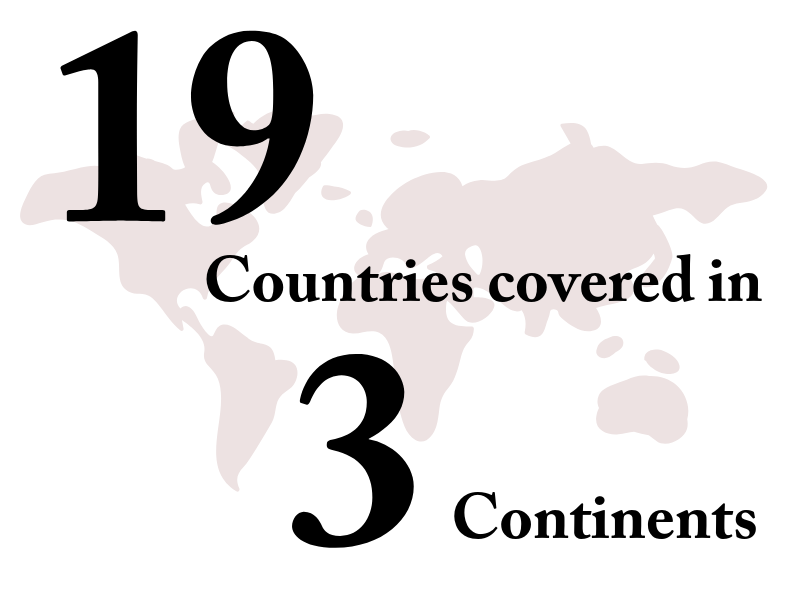

Since Eurazeo PME bought a stake in the group in 2015, Redspher has doubled its turnover to around 300 million euros in 2018. This growth has been evenly balanced between organic and external growth, and has enabled the group to expand its international coverage for instance by acquiring EF Express and Schwerdtfeger in Germany and, more recently, SpeedPack in Spain, and also the UPELA start-up as an additional brick to complement the existing platform. Redspher’s headcount in 2019 stands at over 7600 in Europe and it continues to recruit actively to help it grow.

Ambition

Redspher aims to revolutionize and shape the on-demand transport market by incorporating both its physical and digital dimensions. The group’s growth strategy is an even mix of organic and external growth.

Our Role

We have supported the group since 2015, when we arranged financing of about forty million euros at a time when the capital ownership was being changed (with Eurazeo PME moving in as a minority shareholder).

Various debt solutions were suggested to the management team, but the debt structuring solution proposed by Artemid proved the most popular. It included a large share of debt repayable at maturity, providing a clear credit framework, but offered the group more flexibility for future external growth operations.

In 2019, we once again coordinated a refinancing deal of 110 million euros in which the Artemid Senior Loan II fund participated. This deal will enable the group to pursue its evenly balanced growth strategy (both organic and external) and to expand its geographic coverage.

-

5Dec’ 2024CAPZA supports Primed’s Group next stage of growthCAPZA Private Debt arranges a Unitranche financing to support Primed's Group refinancingRead more

5Dec’ 2024CAPZA supports Primed’s Group next stage of growthCAPZA Private Debt arranges a Unitranche financing to support Primed's Group refinancingRead more -

29Nov’ 2024CAPZA sells its minority stake in MonvisoCAPZA sells its minority stake in Monviso to Argos Wityu, after supporting the Group's developmentRead more

29Nov’ 2024CAPZA sells its minority stake in MonvisoCAPZA sells its minority stake in Monviso to Argos Wityu, after supporting the Group's developmentRead more -

29Oct’ 2024CVC Credit and CAPZA support the acquisition of ILERNACVC Credit and CAPZA announce the co-arrangement of a Unitranche financing to support the acquisition of ILERNARead more

29Oct’ 2024CVC Credit and CAPZA support the acquisition of ILERNACVC Credit and CAPZA announce the co-arrangement of a Unitranche financing to support the acquisition of ILERNARead more -

28Oct’ 2024CAPZA supports the development of JVSCAPZA takes over from Parquest to support the development of JVS, a leader in software publishing for local authoritiesRead more

28Oct’ 2024CAPZA supports the development of JVSCAPZA takes over from Parquest to support the development of JVS, a leader in software publishing for local authoritiesRead more