In'tech Medical

Our flexibility and reactivity were key for In’Tech which was looking for a partner that could match its growth momentum.

Private Debt

2017

Paris

In portfolio

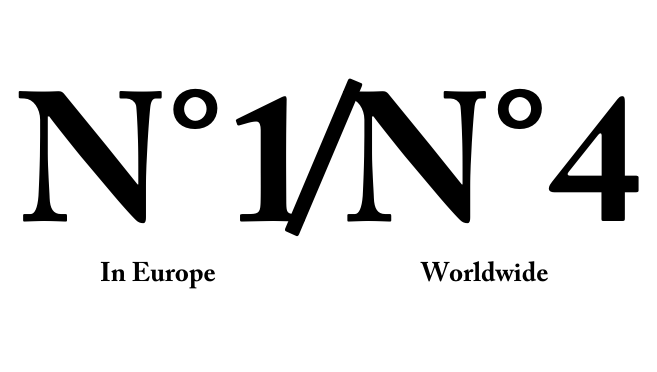

In’Tech Medical manufactures orthopedic surgical tools to be used in the fast-growing spinal surgery sector. The group is a world leader in the knees, shoulders and hips markets. It currently has 800 employees and operations in France, the USA and Malaysia. With two-thirds of its turnover generated in the US market, In’Tech Medical is a key international player.

Context

InTech’Medical underwent an LBO with TCR in 2012. In 2017, Eurazeo PME and the management team were looking for a private lender to provide senior debt in order to finance Eurazeo PME’s acquisition of the company. They sought a private lender in order to keep the process confidential, manage the short timeframe and provide the company with a tailor-made and flexible structure.

Ambition

Following the 2017 LBO with Eurazeo, InTech’Medical’s ambition is to continue consolidating its market share in the spine segment, further diversify its product portfolio and expand its geographic coverage notably in Asia and the USA. This strategy will rely on both organic growth and an active build-up strategy.

Our Role

We had already met up with In’tech in 2011 and were therefore quite familiar with the company as well as the market as we had invested in Marle, a leading manufacturer of hip and knee implants, in 2014.

So our knowledge of the company and the market enabled us to be very reactive and position ourselves to arrange a senior secured financing package. Our ability to execute the transaction in a short timeframe and provide a flexible debt instrument made us the partner of choice for Eurazeo-PME and Intech.

-

18Jul’ 2025CAPZA supports the development of DI EnvironnementCAPZA to acquire strategic minority stake in DI Environnement, a leading player in environmental decontamination services.Read more

18Jul’ 2025CAPZA supports the development of DI EnvironnementCAPZA to acquire strategic minority stake in DI Environnement, a leading player in environmental decontamination services.Read more -

17Jul’ 2025CAPZA Announces an Evolution in its GovernanceOlivier Thoral Appointed CEO, Benoît Choppin Named Head of Private Equity.Read more

17Jul’ 2025CAPZA Announces an Evolution in its GovernanceOlivier Thoral Appointed CEO, Benoît Choppin Named Head of Private Equity.Read more -

17Jun’ 2025CAPZA supports Wifirst in reaching a major milestone in EuropeWifirst is continuing its international expansion with two new acquisitions.Read more

17Jun’ 2025CAPZA supports Wifirst in reaching a major milestone in EuropeWifirst is continuing its international expansion with two new acquisitions.Read more -

7May’ 2025CAPZA sells its minority stake in EduservicesCAPZA exits from Eduservices after supporting the group’s growth.Read more

7May’ 2025CAPZA sells its minority stake in EduservicesCAPZA exits from Eduservices after supporting the group’s growth.Read more