Coutot-Roehrig

In 2019, Coutot-Roehrig entered a new stage of growth and chose CAPZA for the first opening of its capital to a fund.

Primary OBO

2019

France

Exited deals

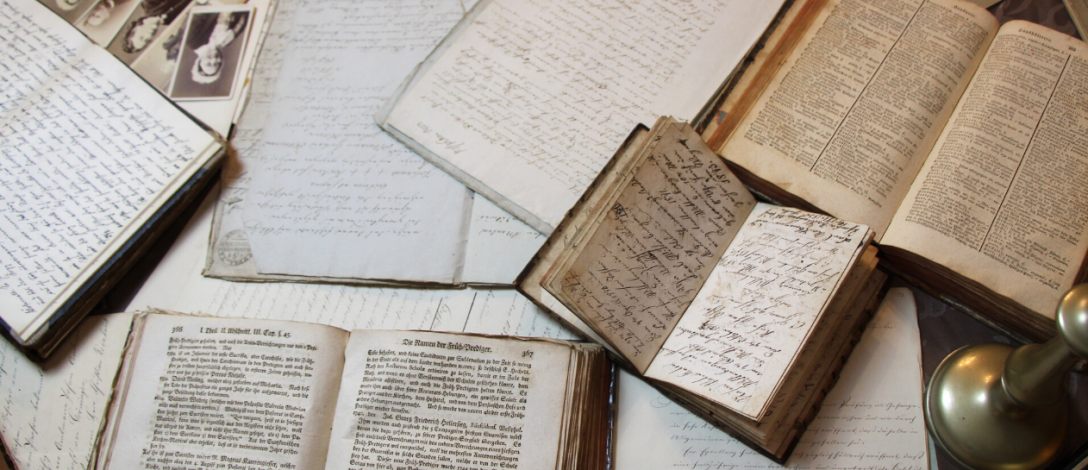

Founded in 1894, Coutot-Roehrig’s core activity consists in identifying heirs in the context of successions, a profession of “long-term” investigator (from a few months to a few years, in France and across the world).

The Group benefits from a solid reputation based on long-standing relationships with notaries’ offices, but also from the largest digital private database in the world. The 300 employees of the Group (genealogists and lawyers) are able to leverage these vast resources with highly competitive reactivity and efficiency, standards for which the Group is well-known.

With its global network of correspondents spanning 46 branches (14 of which are located abroad), Coutot-Roehrig is de facto the European leader in probate genealogy and generates almost €70m in sales.

Context & ambition

The profession of “heir researcher” has become increasingly complex as a result of globalisation and subsequent geographical mobility, but also the lengthening of the human lifespan. Probate research companies must now rely on state-of-the-art tools and develop their international presence in order to carry out their investigations.

As a European leader in probate research, Coutot-Roehrig wished to maintain sustained organic growth while pursuing a targeted acquisition strategy.

For Guillaume Roehrig, CEO of this 100% family-owned SME with a 100-year history, it was necessary to open up the capital in order to accelerate its development: “You have to do it neither too early nor too late and bring in a Fund at a time when you feel you are at the top of the mountain and there is still room for growth.”

In 2019, CAPZA and Bpifrance took part in the Group’s first capital opening via the acquisition of a minority stake.

This operation aimed to support Coutot Roehrig’s organic and external growth and to position the Group as a world leader in its sector.

Our role

CAPZA has been supporting Coutot-Roehrig’s development strategy for more than 3 years, through its Flex Equity expertise.

As specialists in primary transactions, our Flex Equity teams regularly support businesses in their first partnership with a fund: education on the transaction, development support, implementation of key indicators, access to capital for key managers, strengthening of governance, digitalisation projects, assistance in decision-making on strategic issues, etc.

Since CAPZA acquired a stake in Coutot-Roehrig, the Group has completed three external growth operations and undertaken a major digitalisation project. CAPZA has also supported the company in strengthening its operations with the recruitment of a financial director, a human resources director, a CTO and a CIO to oversee the digital project.

Finally, this collaboration also allowed all branch managers to access share ownership, thus favouring a sharing of the value creation between the shareholders and the Group’s main managers.

-

2Feb’ 2026Antoine Druais appointed

2Feb’ 2026Antoine Druais appointed

Co-Head of the Flex Equity Mid-Market TeamCAPZA announces the appointment of Antoine Druais as a Co-Head of the Flex Equity Mid-Market TeamRead more -

29Jan’ 2026CAPZA supports Concerto's growth strategyCAPZA acquires a minority stake in Concerto.Read more

29Jan’ 2026CAPZA supports Concerto's growth strategyCAPZA acquires a minority stake in Concerto.Read more -

28Jan’ 2026CAPZA Partners with UUDSCAPZA Partners with UUDS, a Leading Player in Premium Aircraft Cabin Interior SolutionsRead more

28Jan’ 2026CAPZA Partners with UUDSCAPZA Partners with UUDS, a Leading Player in Premium Aircraft Cabin Interior SolutionsRead more -

21Jan’ 2026Mecadaq and CAPZA accelerate aerospace consolidationMecadaq Group has announced the acquisition of two strategic companies.Read more

21Jan’ 2026Mecadaq and CAPZA accelerate aerospace consolidationMecadaq Group has announced the acquisition of two strategic companies.Read more