Winback

In 2021, Winback enlisted CAPZA’s support to bolster its international development strategy.

LBO

2021

France

In portfolio

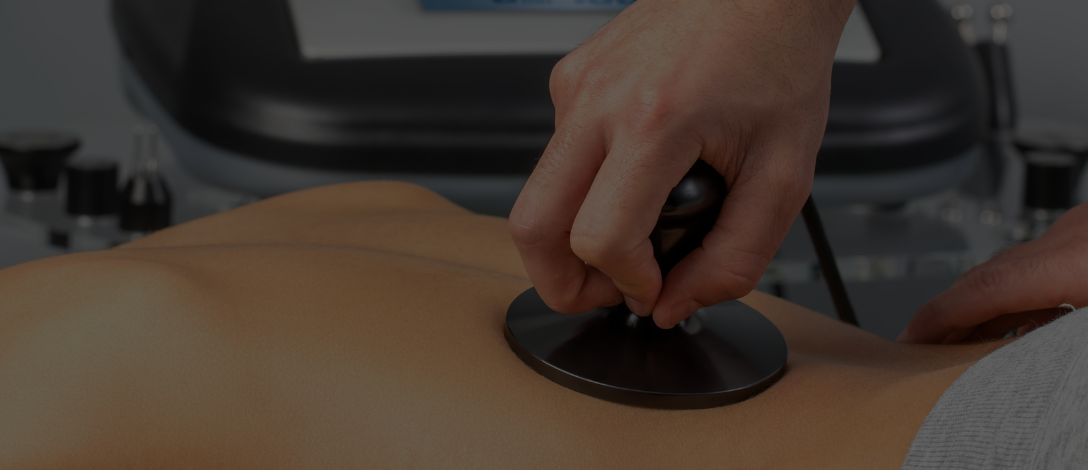

Founded by Christophe Buée and Pierre-Nicolas Lebas, Winback designs, manufactures and distributes innovative medical devices based on three non-invasive technologies (TECAR, cryotherapy and compression).

The applications are primarily therapeutic in the fields of rehabilitation and sport medicine. They aim to treat pain and inflammation to accelerate healing so that patients can regain their mobility as quickly as possible.

The Group is now the worldwide leader of TECAR technology in the rehabilitation segment with 10,000 clients, of which 500 clinics/hospitals and 400 medical teams from sports organizations, and approximately 75,000 treatments performed each day.

With an international and diversified customer base across the 3 continents (Europe, Asia and America), the Group achieved a turnover of almost 35 million euros in 2023, with more than 70% coming from exports.

Context & ambition

In 2021, after almost 10 years of steady growth, Pierre Lebas and Christophe Buée decided to open Winback’s capital to structure the Group further, strengthen teams and accelerate international expansion.

At that time, Winback offered an expanded product range thanks to its robust innovation process. It had already completed four acquisitions in France, Germany, and the United Kingdom over the past three years and established subsidiaries in South Korea and the United States: “Going international was almost unavoidable for a Group like ours operating in a niche market”, emphasizes Pierre Lebas. “To develop an innovative and high-performing platform, we needed to quickly target a global market.”

In December 2021, CAPZA entered Winback’s capital by acquiring a minority stake, alongside the founders and several key executives. This operation aimed to further the Group’s growth overseas, notably through targeted acquisitions, and to continue diversifying its range of products: “What particularly attracted us, explains Fabien Bernez, Partner at CAPZA, was the potential for international development, aimed at consolidating the Group’s position in Europe while expanding into new markets such as the United States and Asia.”

Our Role

CAPZA has been supporting Winback’s development for over two years through its Flex Equity expertise.

As specialists in external growth operations and international development projects, CAPZA’s Flex Equity teams regularly support companies in deploying their international strategy.

According to Pierre Lebas, this approach has borne fruit, as in 2 years, “CAPZA has enabled us to progress in deploying our international presence in multiple ways: first, through strategic reflection on key geographies, notably in the United States, then through contacts with CAPZA offices in Southern Europe, which have allowed us to study external growth opportunities; and finally, through connections with the CAPZA ecosystem and other portfolio companies, which have enabled us to explore commercial opportunities.”

-

16Apr’ 2025CAPZA supports the development of MecadaqCAPZA enters into exclusive negotiations to acquire a majority stake in Mecadaq, a strategic player in the civil and defense aerospace industry.Read more

16Apr’ 2025CAPZA supports the development of MecadaqCAPZA enters into exclusive negotiations to acquire a majority stake in Mecadaq, a strategic player in the civil and defense aerospace industry.Read more -

28Feb’ 2025CAPZA supports Audensiel in its external growth strategyAudensiel continues its international expansion and is entering the Italian market.Read more

28Feb’ 2025CAPZA supports Audensiel in its external growth strategyAudensiel continues its international expansion and is entering the Italian market.Read more -

29Nov’ 2024CAPZA sells its minority stake in MonvisoCAPZA sells its minority stake in Monviso to Argos Wityu, after supporting the Group's developmentRead more

29Nov’ 2024CAPZA sells its minority stake in MonvisoCAPZA sells its minority stake in Monviso to Argos Wityu, after supporting the Group's developmentRead more -

28Oct’ 2024CAPZA supports the development of JVSCAPZA takes over from Parquest to support the development of JVS, a leader in software publishing for local authoritiesRead more

28Oct’ 2024CAPZA supports the development of JVSCAPZA takes over from Parquest to support the development of JVS, a leader in software publishing for local authoritiesRead more